Trustworthy Payroll Management Solutions-- Contact CFO Account & Services for Payroll Services

Trustworthy Payroll Management Solutions-- Contact CFO Account & Services for Payroll Services

Blog Article

Navigating the Intricacies of Payroll Service: A Full Overview for Business Owners

As business owners endeavor into the realm of handling their businesses, the intricacies of pay-roll solutions commonly provide a maze of obstacles to browse. From understanding payroll taxes to making sure conformity with wage regulations, the trip can be overwhelming without an extensive guide. One bad move in taking care of payroll can result in costly consequences for a burgeoning organization. In this complete overview customized for entrepreneurs, we unravel the intricacies of pay-roll solutions, providing strategies and understandings to make and simplify processes informed decisions. Join us on this journey to untangle the intricate world of payroll management and equip your service for lasting development and success.

Recognizing Payroll Taxes

Companies should accurately compute and withhold the right quantity of tax obligations from employees' paychecks based upon factors such as earnings level, filing condition, and any allowances asserted on Type W-4. Additionally, businesses are accountable for matching and paying the suitable section of Social Security and Medicare tax obligations for every worker.

Understanding payroll tax obligations involves remaining updated with tax obligation legislations and regulations, which can be intricate and subject to change. Failing to follow pay-roll tax needs can result in pricey charges and penalties for organizations. Businesses must guarantee they have the understanding and processes in area to take care of payroll tax obligations properly and effectively.

Choosing the Right Payroll System

Navigating pay-roll services for business owners, particularly in understanding and managing pay-roll tax obligations, highlights the crucial value of selecting the best pay-roll system for reliable economic operations. Choosing the suitable payroll system is vital for organizations to simplify their pay-roll processes, guarantee conformity with tax policies, and preserve precise financial documents. Entrepreneurs have several options when it comes to selecting a pay-roll system, varying from hand-operated approaches to innovative software solutions.

When choosing a payroll system, business owners should take into consideration elements such as the size of their company, the complexity of their pay-roll requires, budget plan constraints, and the level of automation desired. Small companies with straightforward payroll needs might select standard pay-roll software program or outsourced pay-roll solutions to handle their payroll jobs efficiently. On the other hand, bigger ventures with even more elaborate payroll frameworks might take advantage of advanced pay-roll systems that use functions like automatic tax calculations, straight deposit capabilities, and integration with accounting systems.

Inevitably, the trick is to select a payroll system that straightens with the organization's details requirements, improves operational efficiency, and ensures accurate and timely pay-roll processing. By selecting the appropriate pay-roll system, business owners can successfully manage their pay-roll responsibilities and concentrate on expanding their businesses.

Compliance With Wage Legislations

Making certain compliance with wage legislations is a fundamental element of keeping legal honesty and moral standards in service operations. Wage legislations are made to protect workers' civil liberties and guarantee reasonable settlement for their job. As a business owner, it is important to remain informed regarding the details wage laws that relate to your service to stay clear of potential legal problems and punitive damages.

Key factors to consider for conformity with wage legislations consist of adhering to base pay demands, properly categorizing staff members as either non-exempt or excluded from overtime pay, and ensuring prompt settlement of salaries. It is also vital to keep up to date with any kind of changes in wage regulations at the federal, state, and local degrees that might affect your business.

To properly browse the complexities of wage laws, consider carrying out pay-roll software program that can aid automate calculations and ensure accuracy in wage payments. Furthermore, looking for advice from lawful specialists or HR experts can provide important understandings and support in maintaining compliance with wage regulations. Contact CFO Account & Services for payroll services. By focusing on compliance with wage laws, business discover here owners can produce a foundation of trust and justness within their companies

Enhancing Payroll Procedures

Performance in handling payroll procedures is vital for entrepreneurs looking for to maximize their service operations and make certain timely and exact settlement for workers. Streamlining pay-roll procedures entails carrying out techniques to streamline and automate tasks, ultimately conserving time and decreasing the threat of errors. One reliable method to streamline pay-roll is by buying pay-roll software application that can centralize all payroll-related information, automate calculations, and produce reports effortlessly. By leveraging technology, business owners can eliminate hands-on data entrance, boost data precision, and guarantee compliance with tax obligation policies.

Furthermore, contracting out payroll solutions to a dependable copyright can additionally simplify the process by unloading jobs to specialists who specialize in payroll monitoring, permitting entrepreneurs to focus on core company activities. By enhancing pay-roll processes, entrepreneurs can enhance effectiveness, precision, and compliance in handling worker payment. Contact CFO Account & Services for payroll services.

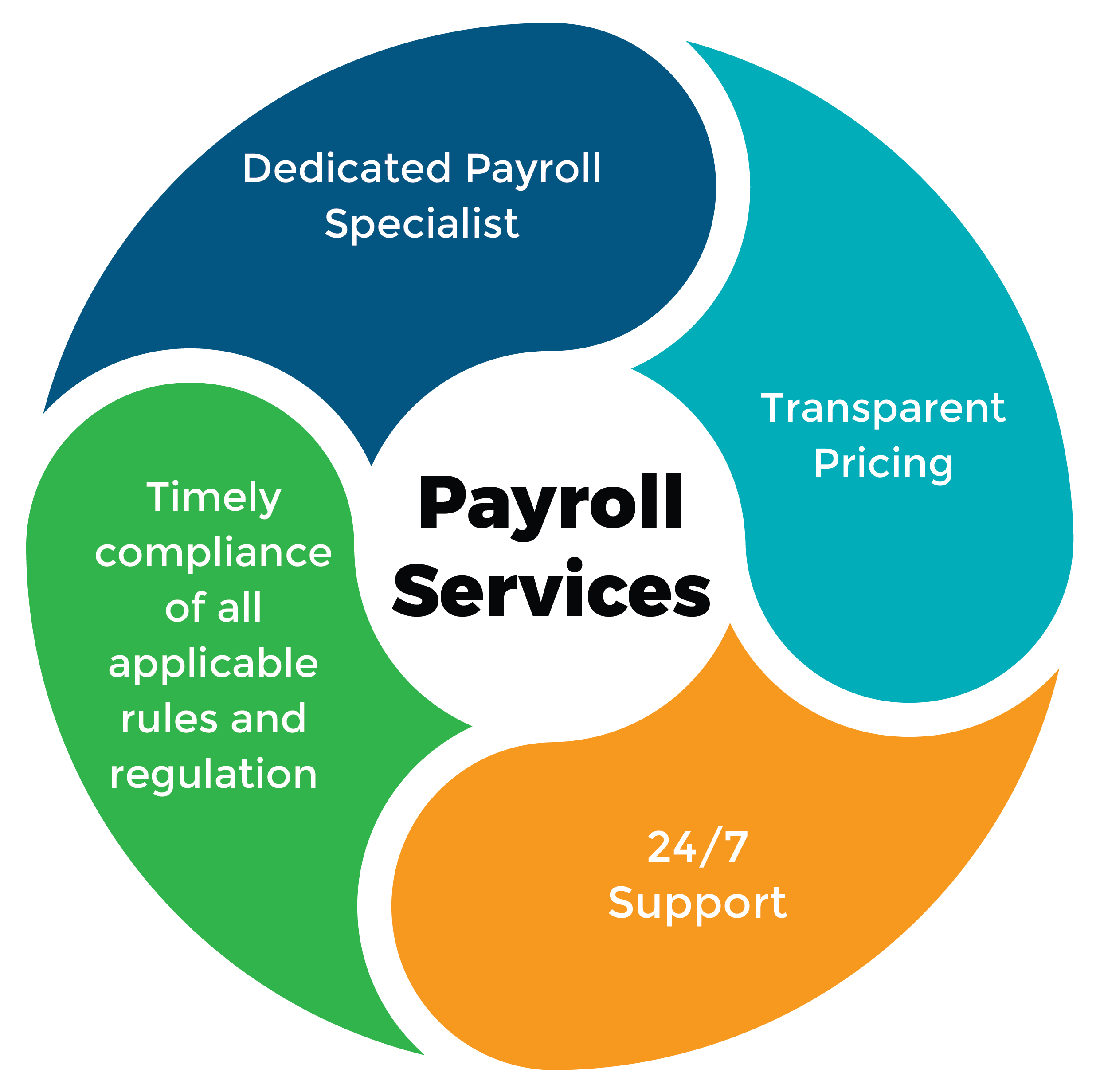

Outsourcing Pay-roll Services

Thinking about the complexity and lengthy nature of pay-roll management, lots of entrepreneurs opt to outsource pay-roll solutions to specialized providers. Contracting out pay-roll solutions can provide numerous benefits to businesses, consisting of price savings, enhanced precision, compliance with tax obligation policies, and liberating important time for business owners to concentrate on core organization activities. By partnering with a credible pay-roll provider, entrepreneurs can make certain that their employees are paid properly and on schedule, tax obligations are calculated and submitted appropriately, and payroll information is firmly handled.

Verdict

To conclude, browsing the intricacies of pay-roll service needs a comprehensive understanding of payroll tax obligations, choosing the suitable system, adhering to wage laws, enhancing procedures, and potentially outsourcing services. Entrepreneurs must thoroughly take care of pay-roll to make certain compliance and performance in their organization procedures. By complying with these guidelines, business owners can successfully handle their payroll obligations and focus on expanding their service.

Report this page